What Sets Us Apart

Our History

1939

Utah Valley Hospital first opened its doors in 1939. With 55 beds and 38 physicians, the hospital was busy from day one.

1951

60 beds were added, bringing the capacity to 115.

1953

At the request of the board of directors, The Church of Jesus Christ of Latter-day Saints assumed ownership of Utah Valley Hospital.

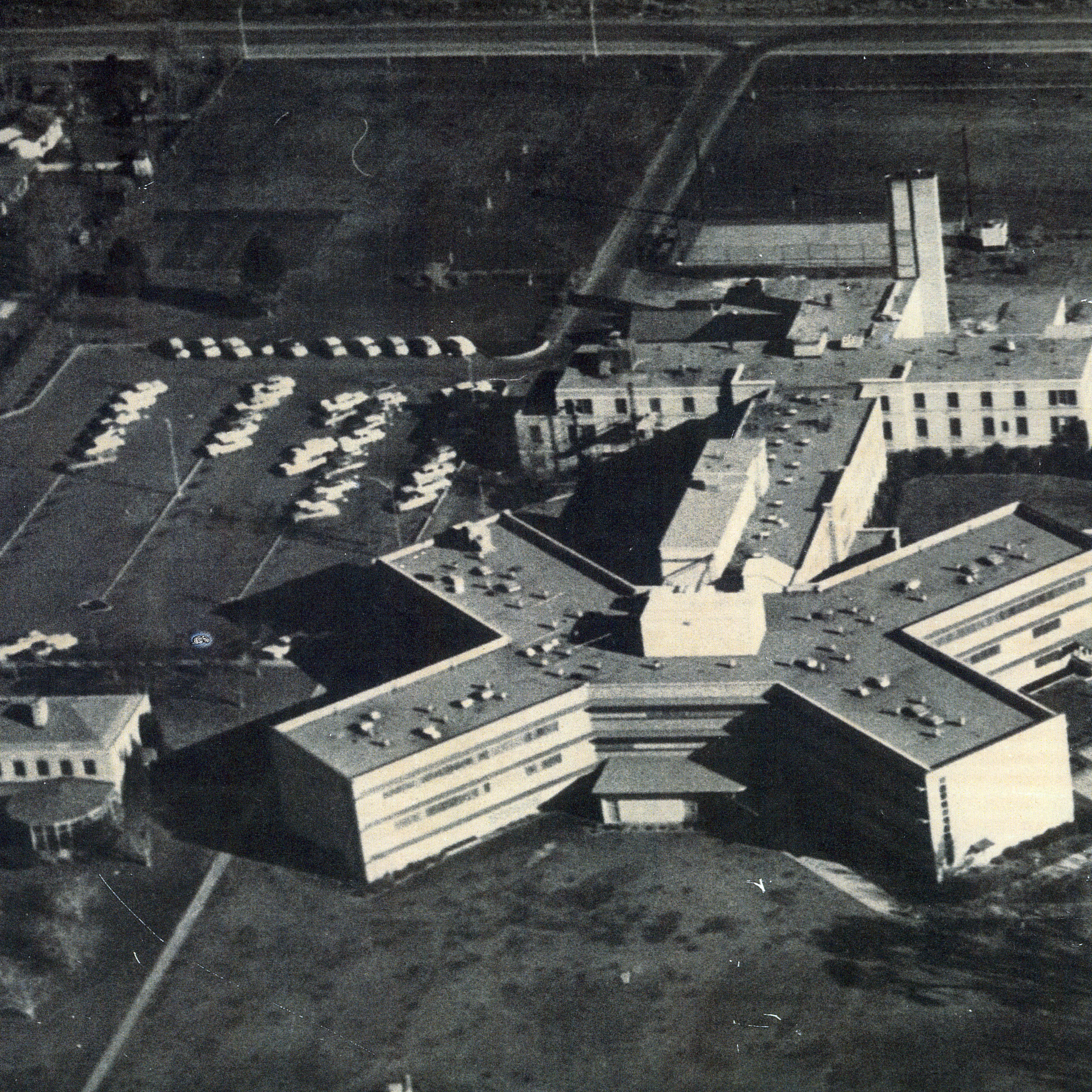

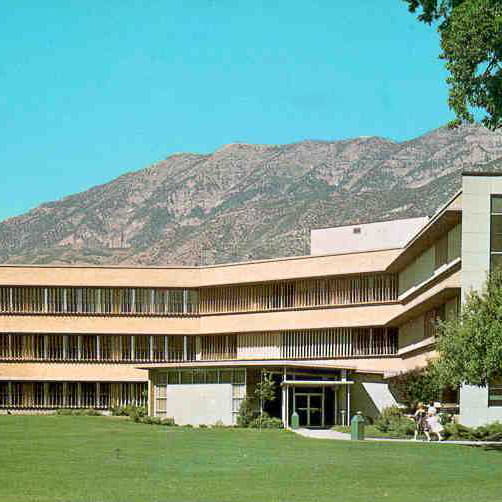

1958

The hospital expanded again with the addition of the iconic X-wing building. This expansion brought the total number of beds to 240.

1970

Utah Valley Hospital became the first fully staffed 24-hour emergency center south of Salt Lake City, and 98 physicians enjoyed medical staff privileges at the hospital.

1975

The Church of Jesus Christ of Latter-day Saints divested its interest in hospitals to the communities the hospitals served. Intermountain Healthcare was established to operate the hospitals on behalf of the community. Construction begins on the seven-story East Tower.

1978

The East Tower is completed, bringing the hospital to 389 beds, 73 nursery bassinets, and a medical staff of 200.

1984

The name of the hospital was officially changed to Utah Valley Medical Center. The name change reflected growth of the facility and services, making it one of Utah's largest major referral centers, serving all of central and southern Utah and its surrounding areas.

1999

The West Building is added to the campus, expanding Women’s and Children’s Services and Same-Day Surgery.

2002

The South Building opens, providing room for clinics, behavioral health services, and administrative offices.

2006

A hyperbaric medicine chamber is added to the South Building.

2014

The hospital celebrates its 75th anniversary, and a major hospital replacement project is announced to eventually replace the East Tower and provide the latest technology and medical services to the community.

2015

Ground is broken, and construction begins, on the hospital replacement project. This project will include a 12-story patient tower on the southwest corner of campus, and a nine-story medical office building on the north side of campus.

2016

The name of the hospital is officially changed back to Utah Valley Hospital. As Utah Valley Hospital grows, it continues its evolution as a place of learning, a place of caring, and a place of healing. The Utah Valley Hospital Primary Children's Network opens, offering the best pediatric care for patients and their families, close to home.

2021

The Hospital Replacement Project is completed, which includes the Utah Valley Clinic in the Sorenson Tower, the Pedersen Patient Tower and a Healing Garden.

Our History

1939

1953

1958

1970

1975

1978

1984

1999

2002

2014

2015

2016

Hospital Leadership

Kyle Hansen, FACHE

CEO/Administrator

Maria Black, APRN

Nurse Administrator

Mile Hawley, MD

Medical Director

Karen Dominguez, RN

Operations Officer

Josh Rohatinsky

Administrative Director

Bill Hulterstrom

Governing Board Member

Cydni Tetro

Governing Board Member

Patricia Ravert, PhD, RN

Governing Board Member

Belinda Talonia

Governing Board Member

Brigitte Madrian, PhD

Governing Board Chair

Curt Pulsipher, PhD

Governing Board Member

Boyd Craig

Governing Board Member

Everett Kelepolo, EdD

Governing Board Member

Mary Crafts

Governing Board Member

Matt Packard

Governing Board Member

Shellie Baertsch

Governing Board Member

Andrew Dadson

Governing Board Member

Steven Anderson, PhD

Governing Board Member