Even if retirement seems a long way off, now is the time to begin planning and saving for it. Intermountain Health offers convenient, easy, and tax-advantaged plans through T. Rowe Price to help you keep building savings for your future.

Beginning April 3, 2023, all retirement plan portfolios were transferred to T. Rowe Price.

Retirement Plan Details* as of April 1, 2023:

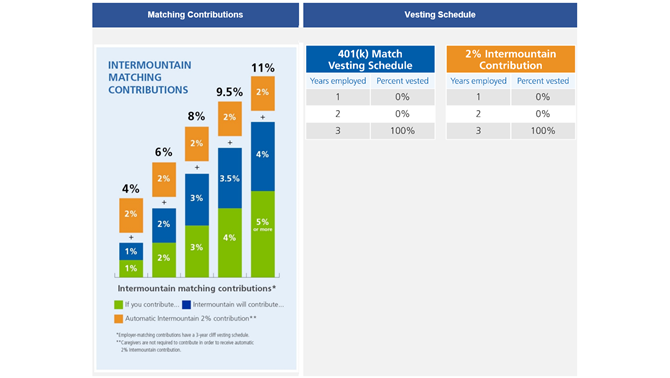

- Matching employer contributions: 100% match on the first 3% you contribute, then 50% match on the next 2% you contribute.

- Basic employer contribution: Even if you decide not to contribute to the retirement plan, Intermountain Health will automatically contribute 2% of your eligible earnings to your pre-tax 401(k) account. That's free money for you as a thank-you for your service and dedication!

- Roth option: You can choose to contribute to the pre-tax 401(k) or the Roth after-tax option…or both.

- Investment options: You decide how to invest your retirement funds depending on your risk tolerance and years until retirement.

- 3-year vesting schedule: Your contributions are always vested. Employer contributions vest after 3 years of service.

*Note: Union members should refer to their collective bargaining agreement for eligibility.

Intermountain Health caregivers:

-

Need to learn more? Click HERE for details. You may also reach out to T. Rowe Price by phone at 800-922-9945 or review your account online at rps.troweprice.com.